The Bank of Ghana has confirmed that its Domestic Gold Purchase Programme (DGPP) and the associated Gold-for-Reserves (G4R) scheme have incurred significant financial losses since their inception, directly confirming a statement made by CEO of Goldbod, Sammy Gyamfi, Esq.

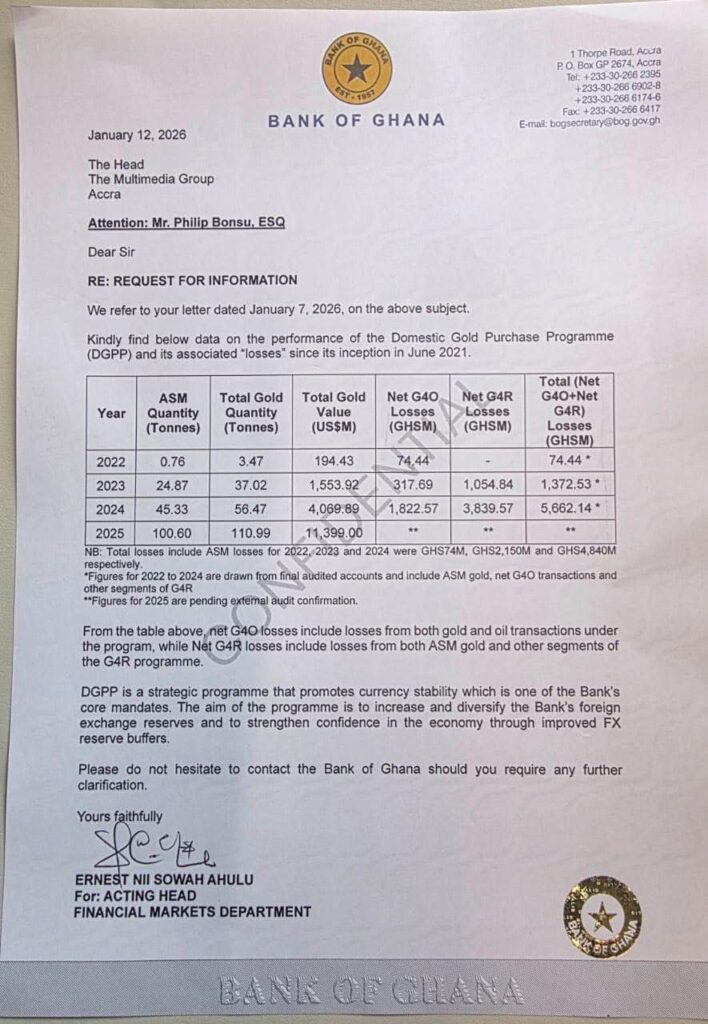

In a formal response dated January 12, 2026, and signed by Acting Head of the Financial Markets Department, Ernest Nii Sowah Ahulu, the central bank disclosed audited loss figures totalling more than GH¢7 billion between 2022 and 2024.

According to the letter, the programme recorded losses of GH¢74.44 million in 2022, GH¢1.553 billion in 2023 and GH¢4.068 billion in 2024, all of which include losses from gold-for-oil transactions, reserve gold purchases and costs associated with the artisanal mining supply chain.

While figures for 2025 are still subject to external audit confirmation, the Bank noted that provisional data will likely show additional losses once finalised.

The release of the figures marks the first time the central bank has publicly confirmed the scale of the programme’s financial exposure, contradicting repeated political statements that no losses were recorded.

Despite the losses, the Bank underscored what it described as strong operational delivery under the programme, particularly through the artisanal and small-scale mining (ASM) supply channel.

Since its launch in mid-2021, the DGPP has sourced rapidly increasing volumes of gold from licensed aggregators, including Goldbod, whose deliveries form a core component of the refinery-grade gold used to build reserves and support the exchange rate.

ASM-sector supply rose from less than one tonne in 2022 to more than 24 tonnes in 2023 and over 45 tonnes in 2024, with provisional supplies surpassing 100 tonnes in 2025.

The Bank suggested that the ability of aggregators such as Goldbod to scale up mobilization played a pivotal role in enabling the programme to accumulate and swap gold for fuel and to hedge against foreign exchange volatility at a time of high import pressure.

The Bank insisted the DGPP and G4R remain strategic and are intended to strengthen foreign exchange buffers, reduce reliance on the US dollar and reinforce confidence in the cedi, arguing that short-term accounting losses should be assessed against broader balance-of-payments benefits.

“The programme is to increase and diversify the Bank’s foreign exchange reserves,” the letter noted, emphasising that losses capture valuation and operational factors rather than wastage or fraud.

The disclosure is expected to sharpen the political debate surrounding the programme, with the Minority having publicly insisted that the central bank incurred no losses under their tenure from 2021 to 2024.

Bank of Ghana’s data was released following a Right-To-Information request by Host of Asempa FM’s ‘Ekosiisen’ Program, Philip Osei Bonsu.

In a letter dated January 7, 2026, Mr. Osei Bonsu asked the Bank of Ghana to confirm information from GoldBod that the Gold-For-Reserve prorgramme has incurred losses since its inception.

He asked the Bank of Ghana to publish information on the volume of gold purchased for each year, the value of gold purchased for each year and profits or losses, if any, for each year since the inception of the Gold-For-Reserve programme.