The Bank of Ghana has told Parliament’s Public Accounts Committee that rising operational costs recorded under Ghana’s gold-linked programmes are being driven primarily by a surge in gold volumes now flowing through formal channels, led by licensed aggregators such as Goldbod.

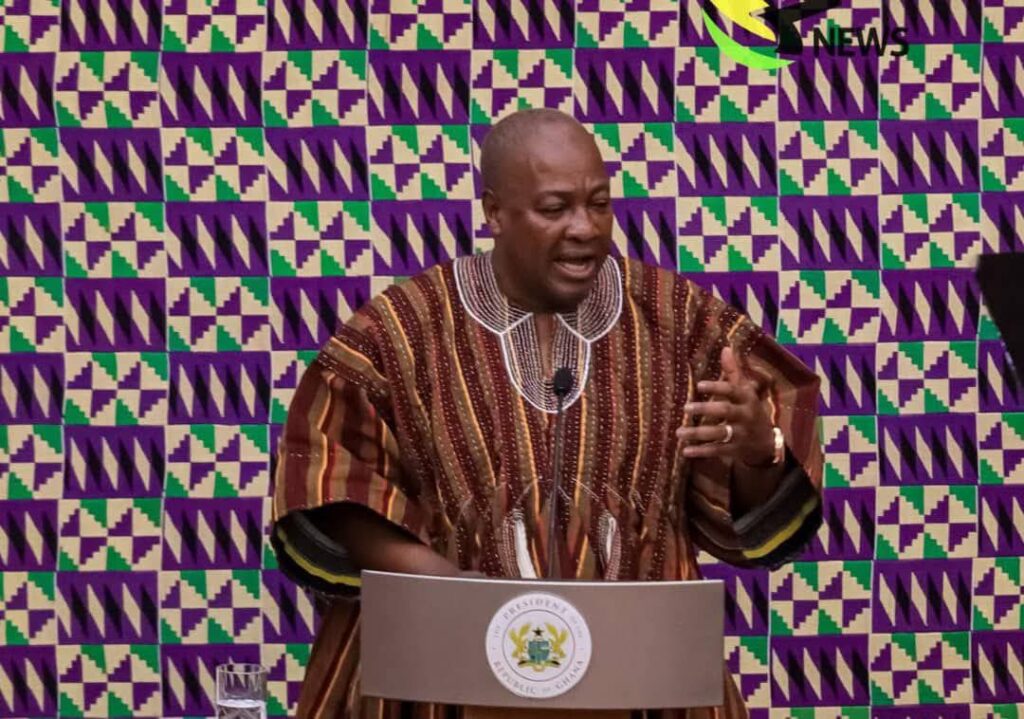

Governor Dr. Johnson P. Asiama, appearing before the Committee, said the shift away from smuggling and informal export routes toward compliant buyers is evidence that the national gold framework is working as intended, even if the transition has temporarily placed financial pressure on the central bank.

MPs examined reported programme losses, highlighting that the Bank’s 2024 financial statements clearly recorded GHS 1.8 billion in Gold for Oil–related costs while public debate has cited a GHS 3.8 billion number.

The Committee requested clarity on how these figures reconcile. Dr. Asiama assured members that the Bank will provide a breakdown to account fully for the allocations.

The Governor explained that formal aggregation and export designed to lock value in-country entail unavoidable costs, particularly in the programme’s early phases.

He said the Bank has had to bridge funding gaps during 2024 and into 2025 when budgeted government support arrived late, noting that procurement could not stop without undermining market confidence.

Dr. Asiama pointed to the USD 270 million (about GHS 4.5 billion) allocation in the 2025 national budget for gold-related activities, stating that the Bank’s temporary assumption of costs ensured continuity across buying, aggregation, refining and export channels.

Crucially, he emphasised that rising formal gold volumes reflect the work of the growing network of licensed aggregators feeding the programme.

Companies such as Goldbod, he said, have been “instrumental” in scaling up legal, traceable procurement that previously leaked through illicit export pipelines.

The Governor described this as a turning point, arguing that gold now retained in the system supports reserves, strengthens the foreign exchange position and improves price stability.

He rejected claims suggesting the increased volumes of gold accumulated indicate a spike in illegal mining.

Formalisation, he said, must be assessed separately from enforcement, which continues across mining communities.

The real story, he noted, is that reputable private-sector aggregators are finally capturing gold that would otherwise be smuggled.

On concerns raised by the IMF, Dr. Asiama clarified that the Fund had not objected to the gold programmes.

Instead, it recommended that the Bank should not permanently absorb the full cost of what are, in practice, government responsibilities.

He said the Bank agrees with this assessment and is coordinating a sustainable cost-sharing arrangement with the Ministry of Finance.

Committee members referenced Ghana’s Extended Credit Facility commitments, which restrict central bank financing of quasi-fiscal activities, and stressed the importance of formalising the fiscal pathway for gold programme expenditure. Some MPs suggested legislation may be necessary.

Dr. Asiama appealed for bipartisan support for reforms to protect the gains achieved so far from improved reserve buffers to more stable exchange rates and moderated consumer prices while shifting financial responsibility to the appropriate agencies.

He added that the Bank remained policy solvent at the end of 2024, with 2025 accounts still in preparation.

The Committee is expected to revisit the issue after receiving further documentation on losses and a proposed framework to sustain partnerships with licensed aggregators such as Goldbod without overburdening the central bank.